The electric bike (e-bike) industry is gearing up for an electrifying decade. With an estimated market value of USD 39.6 billion in 2025, global revenues are forecast to hit USD 58.6 billion by 2035, according to the latest outlook. This steady 4.0% CAGR growth paints a picture of a sector moving from niche adoption to mainstream mobility, fueled by technology, urbanization, and sustainability-driven policies.

But beyond the numbers, the story of e-bikes is a story about changing lifestyles, greener cities, and smarter transportation solutions.

Why E-bikes Are Winning the Commute

E-bikes are no longer just a novelty for eco-conscious riders—they are fast becoming a mainstream urban mobility choice. Rising fuel prices, clogged cities, and the global health push toward active lifestyles are all working in their favor.

From regenerative braking and digital dashboards to IoT-enabled fleet tracking, e-bikes today are as much about smart mobility as they are about pedaling convenience. Add to this the wave of government subsidies, cycling infrastructure investment, and low-emission zone regulations, and the adoption curve starts to make perfect sense.

For daily commuters, city planners, and even logistics operators, e-bikes offer what cars and public transport often can’t—last-mile connectivity, flexibility, and cost efficiency.

The City Bike Takes the Lead

When it comes to what type of e-bike dominates the streets, the answer is clear: city and urban bikes. In 2025, this segment will capture 42.7% of the market share, a testament to the growing number of commuters choosing compact, upright, and easy-to-handle bikes for short to mid-distance travel.

Features like step-through frames, integrated lighting, cargo carriers, and software-based power management make them practical across age groups and demographics. With governments expanding bike lanes and last-mile commuting programs, city bikes are only expected to tighten their grip on the market.

Batteries Powering the Revolution

Behind every successful e-bike is a battery—and lithium-ion batteries are running the show. Expected to hold 56.3% of the market share in 2025, lithium-ion technology outpaces older alternatives thanks to high energy density, quick charging, and long lifecycle performance.

The segment’s dominance is also being boosted by global regulatory support for cleaner energy storage, innovations in solid-state battery research, and initiatives for second-life battery reuse. Simply put, the e-bike revolution rides on the shoulders of lithium-ion—and the chemistry is only getting better.

Motors: Hub vs. Mid-Drive

When it comes to propulsion, hub motors are the unsung heroes. Contributing 53.8% of market share in 2025, they win on simplicity, cost-effectiveness, and low maintenance. Their quiet operation, aesthetic concealment, and suitability for city bikes make them a natural fit for commuters.

Meanwhile, mid-drive motors are gaining traction in premium and performance bikes, particularly in Europe’s leisure and sports biking segments, where torque and hill-climbing capabilities matter more.

Key Trends Shaping the Future

Like any fast-evolving industry, the e-bike market is being shaped by a mix of drivers, restraints, and opportunities:

- Technology-led adoption: Pedal-assist systems, torque sensors, GPS tracking, and app-based ride stats are making bikes smarter and more personalized.

- Mobility-as-a-service (MaaS): Shared e-bike rentals and subscription services are carving out new revenue streams.

- Urban infrastructure: Dedicated cycling lanes and charging hubs are driving adoption in cities worldwide.

- Affordability challenges: High upfront battery costs and fragmented regulations continue to restrain growth in certain regions.

- Design innovation: Lightweight, foldable frames and modular batteries are opening doors for storage convenience and multimodal commuting.

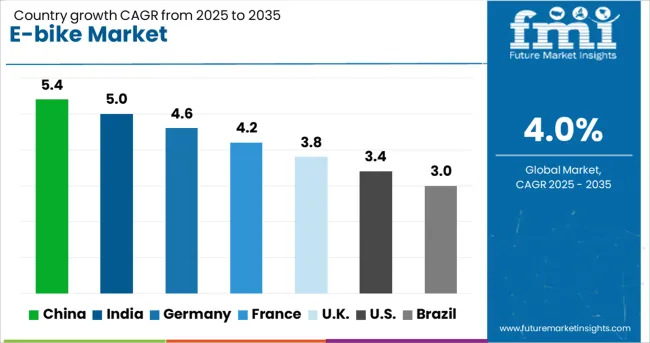

Regional Growth Leaders

Growth in the e-bike industry is not evenly distributed. Some regions are accelerating faster than others:

- China (CAGR: 5.4%): The global powerhouse in e-bike production, supported by domestic policies and exports to Europe and Southeast Asia.

- India (5.0%): Driven by government-backed EV programs and rising urban demand for affordable mobility.

- Germany (4.6%): Premium commuter and leisure bikes dominate, supported by bike-friendly policies.

- France (4.2%): Rental platforms, foldable bike demand, and e-commerce-led distribution fuel growth.

- UK (3.8%): Shared e-bike schemes and urban congestion charges are helping adoption in metropolitan areas.

- USA (3.4%): Moderate growth driven by lifestyle biking and sustainability programs, though lagging behind Asia and Europe.

Industry Heavyweights

Competition in the e-bike sector is heating up, with global giants and niche specialists all racing for a slice of the market.

- Yadea Technology Group (China): Leading with large-scale production and next-gen sodium-ion battery innovations.

- Trek & Giant (USA & Taiwan): Dominating the premium, performance, and commuter categories with high-tech offerings.

- Rad Power Bikes (USA): Carving out a niche in cargo and utility e-bikes, with consumer-friendly pricing and direct-to-customer models.

- Accell Group (Europe): Leveraging a multi-brand strategy and digital connectivity features to reach diverse markets.

- Merida, Scott Sports, Tern, Brompton, and Polygon: Regional specialists focusing on folding, compact, and urban-specific designs.

The competitive edge will increasingly come from battery performance, IoT integration, and lightweight design, with brands that blend affordability and innovation poised to win big.

What’s Next for E-bikes?

The next decade is about mainstream adoption. With annual revenue growth accelerating toward 2035, the sector will see innovations like solid-state batteries, regenerative braking systems, foldable smart frames, and app-driven ecosystem integration.

Shared mobility will expand, especially in emerging cities across Asia-Pacific and Latin America, while Europe will remain the hub of premium and performance e-bikes. Governments, too, will play a defining role—whether through subsidies, infrastructure investment, or environmental regulations.

Key Companies Profiled

- Yadea Technology Group Co.,Ltd.

- Trek Bicycles

- Giant Bicycles

- Rad Power Bikes,LLC,

- Accell Group

- Merdia Bikes

- Scott Sports Sa

- Tern

- Brompton Bicycle Ltd

- Polygon Bikes

The e-bike revolution is no longer a trend—it’s the future of urban mobility. The real winners will be the companies and cities that move fastest to embrace smarter, greener, and more connected transport solutions.

Reference: https://www.futuremarketinsights.com/reports/e-bike-market