The global electric vehicle (EV) revolution isn’t just about batteries, motors, and sleek new designs—it’s also about the hidden components making it all possible. One such hero is the humble relay, a critical device that manages high-voltage circuits inside electric cars, ensuring safe and reliable power distribution.

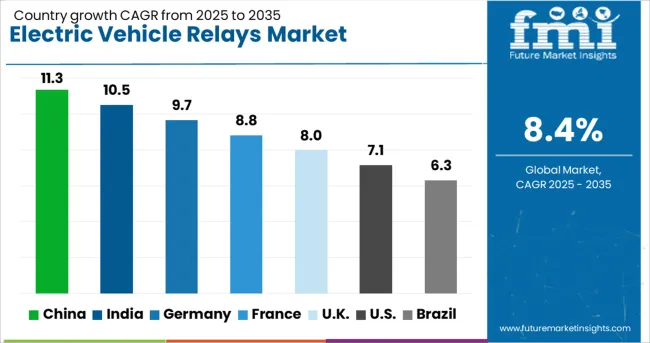

According to the latest industry outlook, the Electric Vehicle Relays Market is on track to soar from USD 3.7 billion in 2025 to USD 8.3 billion by 2035, growing at a compound annual growth rate (CAGR) of 8.4%. This rapid growth mirrors the surging demand for EVs worldwide, driven by stricter emission regulations, improved charging infrastructure, and the global shift toward sustainable mobility.

A Decade of Strong Growth Ahead

Between 2025 and 2030, the market is set to expand from USD 3.7 billion to USD 5.5 billion, adding nearly USD 1.8 billion in value. This early phase of growth will be fueled by the rising penetration of battery electric vehicles (BEVs) and hybrids, particularly across Asia-Pacific and Europe, where zero-emission mandates are gathering pace.

From 2030 to 2035, the market will accelerate further, climbing to USD 8.3 billion. Analysts expect stronger adoption of solid-state relays and thermal management solutions as vehicles increasingly shift to 800V and higher battery systems, enabling ultra-fast charging.

Why Relays Matter in the EV Boom

Think of relays as the traffic police inside an EV’s electrical highway. They direct current safely, protect against overloads, and isolate circuits when faults occur. With EVs operating at voltages of 400V to 800V—or even higher—reliability is non-negotiable.

Relays play crucial roles in:

- Battery Management Systems (BMS) – ensuring safe charging, discharging, and thermal protection.

- Drive Systems – managing high current for traction motors.

- Charging Infrastructure – supporting fast and ultra-fast charging.

- Safety Features – enabling emergency disconnect and interlock functions.

Key Segments Driving Growth

- By Product

The contactor relay segment is expected to dominate in 2025, commanding 34% of market revenue. Known for handling high current loads with mechanical isolation, these relays are indispensable for battery safety and protection during surges. - By Vehicle

Passenger cars will lead the way, capturing 61% of the market share in 2025. With consumer appetite for electric sedans, SUVs, and crossovers surging, automakers are integrating compact, noise-free relays to enhance driving experience. - By Propulsion

Battery electric vehicles (BEVs) will be the biggest contributors, holding a 66% share in 2025. Unlike hybrids, BEVs rely entirely on electronic systems, meaning they use more relays per vehicle.

Regional Spotlight

The global landscape shows fascinating contrasts in growth rates:

- China: Leading with a blistering 11.3% CAGR through 2035, powered by strong domestic production, clean mobility mandates, and a localized supply chain.

- India: Close behind at 10.5% CAGR, driven by electrification of two- and three-wheelers, cost-sensitive relay solutions, and expanding fast-charging networks.

- Germany: At 9.7% CAGR, focusing on premium EVs with advanced relay solutions meeting strict safety norms.

- United Kingdom: Growing at 8% CAGR, boosted by government-backed electrification and battery-swapping innovations.

- United States: Posting 7.1% CAGR, emphasizing solid-state relay technologies and expansion of high-speed charging corridors.

Challenges and Restraints

Despite the promising outlook, the industry isn’t without hurdles:

- Cost Pressures: Advanced arc-quenching and sealed relays come at a premium, challenging mass-market adoption.

- Durability Concerns: Contact wear under high-frequency switching poses reliability risks.

- Standardization Gaps: Regional variations in safety and performance standards complicate global sourcing for OEMs.

Competition Heats Up

The market is highly competitive, with established players racing to innovate:

- TE Connectivity: Leading with advanced relays built for 800V systems and arc suppression.

- Panasonic: Leveraging expertise in compact, energy-efficient automotive electronics.

- Fujitsu: Known for low contact resistance and mechanical endurance.

- Omron Corporation: Recently launched the G9EK High-Voltage DC Relay for EVs and renewable energy, focusing on compact design and arc control.

- Xiamen Hongfa Electroacoustic: Competing aggressively on price and large-scale production in emerging Asian markets.

The competitive edge will increasingly favor companies that deliver miniaturized, lightweight, and thermally robust designs, aligned with next-generation EV architectures.

The Road Ahead

Industry insiders agree the next decade will be transformative. Solid-state relays, predictive maintenance features, and even 3D-printed components could reshape how these devices are designed and deployed. Integration with artificial intelligence for real-time monitoring of relay performance is also on the horizon.

“Relays are evolving from simple switches to intelligent guardians of EV safety and efficiency,” noted a senior executive from a leading relay manufacturer. “The push toward carbon-neutral transportation means these components will only grow in importance.”

Key Companies Profiled

- TE Connectivity

- Panasonic

- Fujitsu

- Omron Corporation

- Xiamen Hongfa Electroacoustic

By 2035, with a projected value of USD 8.3 billion, the sector will be a silent but powerful force underpinning the global EV transition. For investors, policymakers, and consumers, that makes relays more than just a component—they’re a cornerstone of the sustainable mobility future.

Reference: https://www.futuremarketinsights.com/reports/electric-vehicle-relays-market