The humble battery is no longer just a power source—it’s the beating heart of our connected world, and it’s undergoing a revolution. From powering the smartphones in our pockets to keeping electric vehicles (EVs) on the road and storing renewable energy for entire neighborhoods, batteries have become the silent workhorses of modern life. Now, a new shift is underway: the rise of battery platforms, modular and standardized systems that promise flexibility, scalability, and cost efficiency across industries.

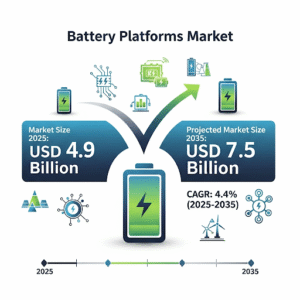

According to fresh market forecasts, the global battery platforms market is expected to grow from USD 4.9 billion in 2025 to USD 7.5 billion by 2035, marking a 53.5% growth over a decade. This steady climb reflects a compound annual growth rate (CAGR) of 4.4%, signaling not a sudden boom but a resilient, sustained expansion. By 2035, the industry will have grown nearly 1.54 times its 2025 size, reshaping how industries think about energy storage.

What’s Driving the Market?

The growth story of battery platforms is rooted in three big shifts: electrification, modularity, and sustainability.

- Electrification: With electric vehicles moving from niche to mainstream, carmakers are embracing scalable battery designs that can power everything from compact city cars to heavy-duty pickup trucks. Instead of designing bespoke batteries for each model, manufacturers are adopting flexible platforms that reduce costs and speed up time-to-market.

- Modularity: Think of battery platforms like Lego blocks. Manufacturers can use the same building blocks across multiple applications—cars, tools, energy storage units—while adjusting only what’s necessary. This modularity doesn’t just save money; it also enables faster repairs and longer product lifecycles.

- Sustainability: With governments pushing for recycling, reuse, and circular design, platforms are increasingly being built to last beyond their first life. Once a battery has served its time in a car, for instance, it can find a second life in grid storage or home backup systems.

Market Segments in Focus

Lithium-Ion Takes the Lead

Not surprisingly, lithium-ion batteries dominate the field, holding a 55% market share in 2025 and expected to grow at a 5.4% CAGR through 2035. Their versatility—spanning EVs, consumer electronics, and power tools—combined with falling costs, has made them the clear favorite. Advances in safety and lifecycle performance are expected to keep lithium-ion batteries at the center of platform innovation, even as solid-state batteries start edging into the market.

Tool Batteries Power Ahead

Interestingly, it’s not just cars driving the growth. Tool battery platforms—the kind used in power drills, saws, and outdoor landscaping equipment—are projected to account for 70% of the market in 2025. OEMs have learned that professional contractors and DIY enthusiasts alike prefer ecosystems where one battery fits multiple tools. This has created a stickiness effect, with users often sticking to a brand once they’ve invested in its platform.

Power Tools and Outdoor Equipment Lead Applications

By application, power tools and outdoor equipment represent the largest share at 35% in 2025. The global shift from corded to cordless tools has spurred demand for reliable, swappable battery packs. Professionals are particularly interested in platforms offering backward compatibility, fast-charging, and rugged durability.

Global Growth Outlook

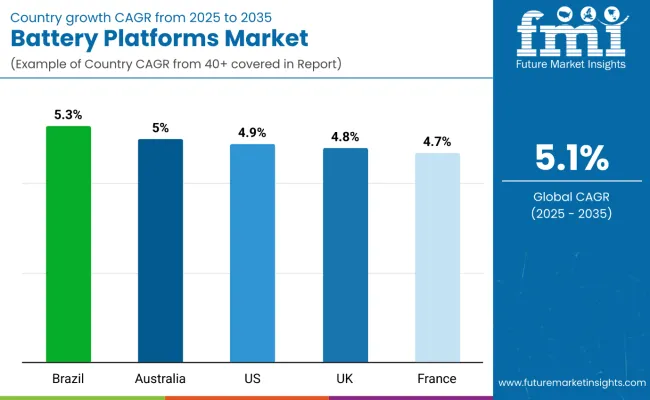

The growth of battery platforms isn’t evenly spread—it’s shaped by local priorities, policies, and industries.

- United States: The U.S. is becoming a powerhouse in platform production, thanks to tax incentives and federal support. EV makers are standardizing modular battery designs, while startups are repurposing used EV batteries for grid storage.

- Europe: Europe’s market is set to grow from USD 1.16 billion in 2025 to USD 1.86 billion by 2035, anchored by Germany, France, and the UK. Germany remains the leader, though France is quickly catching up with its state-backed gigafactories. Circular economy regulations in Europe are also pushing platforms designed with recycling and reuse in mind.

- Japan: Known for precision and safety, Japan favors tool-specific platforms. Tool batteries hold a dominant 65% share here, reflecting the country’s emphasis on consistent load handling and thermal stability.

- South Korea: South Korea leads with lithium-ion platforms (70% share) spanning automotive, industrial, and consumer electronics. Its export-driven approach ensures global compatibility of designs.

- Brazil and Australia: These two emerging regions are stepping up fast. Brazil is developing localized EV ecosystems, while Australia is leveraging its mining strength to integrate raw material processing with platform assembly.

Key Trends to Watch

Several themes are shaping the battery platform landscape:

- Multi-Vehicle Integration: Platforms that work across multiple vehicle categories are becoming standard. This allows automakers to streamline R&D and share costs across compact cars, SUVs, and vans.

- Thermal Management & Safety: With rising power density comes rising risks. Advanced cooling systems, thermal interface materials, and real-time monitoring are being built into platforms to prevent overheating and fires.

- Second-Life Applications: As first-life EV batteries retire, they’re increasingly being repurposed for energy storage. This is both environmentally friendly and economically viable.

- Automation in Manufacturing: Companies like Honeywell are rolling out automation software for gigafactories, using robotics and digital twins to cut waste and improve efficiency.

Competitive Landscape

The market is crowded with both legacy giants and nimble newcomers. Tesla, LG Energy Solution, Panasonic, Bosch, and BYD remain key players, but innovation is coming from all corners.

- In July 2025, Enovix launched its AI-1™ silicon-anode platform, boasting 65% higher energy density than conventional cells.

- Around the same time, Honeywell introduced an automation suite to streamline battery production.

- In August 2025, Advancion partnered with the U.S. Department of Energy to open a pilot line for next-gen lithium-ion cells using domestically sourced materials.

This mix of technology innovation and supply chain localization signals a fiercely competitive decade ahead.

Companies

- Tesla, Inc.

- LG Energy Solution

- CATL (Contemporary Amperex Technology Co. Limited)

- DeWalt (Stanley Black & Decker)

- Makita Corporation

- Bosch Power Tools

- Milwaukee Tool (Techtronic Industries)

- Panasonic Corporation

- Samsung SDI

- Renon India

- Others

- BYD

Battery platforms are no longer just tech behind the scenes—they’re the spark driving the electric future. In the next decade, they’ll power everything from your tools to your ride, and maybe even your home.

Reference: https://www.futuremarketinsights.com/reports/battery-platforms-market