The electric revolution isn’t just about cars—it’s about the tools that make them safe, reliable, and ready for mass adoption. As the world races toward greener mobility, a critical but often overlooked industry is quietly booming: electric vehicle (EV) test equipment.

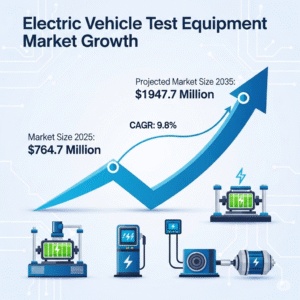

According to fresh market research, the global Electric Vehicle Test Equipment Market is expected to jump from USD 764.7 million in 2025 to an impressive USD 1.95 billion by 2035, growing at a steady 9.8% CAGR over the decade.

Why Testing Matters in the EV Boom

While EV headlines often focus on shiny new models, charging stations, or government incentives, another story is unfolding in research labs and production lines worldwide.

Every electric car, from a compact city EV to a heavy-duty electric bus, undergoes rigorous checks before hitting the road. Specialized test systems simulate real-world conditions—heat waves, freezing nights, fast-charging cycles, and high-speed drives—to ensure safety, efficiency, and compliance.

“Testing is the unsung hero of the EV industry,” says an industry analyst. “Without it, batteries could fail, charging systems might malfunction, and vehicles wouldn’t meet global safety standards. As EV adoption grows, so does the demand for smarter, faster, and more adaptable testing tools.”

Passenger Cars Drive the Majority of Demand

By 2025, passenger cars are expected to account for 61.5% of the market’s demand for test equipment. This dominance reflects the surge in electric car adoption worldwide, powered by expanding charging networks, falling battery costs, and government incentives.

Passenger EVs bring complex challenges. Their batteries, motors, and control systems must be tested under various conditions to ensure smooth performance. This is pushing manufacturers to develop flexible and modular test solutions that can adapt to evolving vehicle architectures.

Simply put, as the global appetite for electric cars grows, the test equipment sector grows alongside it.

BEVs Take the Lead in Testing Needs

Within fuel categories, Battery Electric Vehicles (BEVs)—the zero-emission champions—hold a commanding 48.9% market share. Their reliance on high-capacity batteries makes testing even more crucial.

From thermal efficiency checks to motor diagnostics and battery lifecycle validation, BEVs require advanced tools that can simulate years of wear in compressed timeframes. With gigafactories sprouting globally and solid-state battery research advancing, the demand for high-throughput and automated testing equipment will only accelerate.

Components: The Heart of EV Testing

Another hotbed of activity is component testing, representing 29.7% of applications. Think of this as the “microscope” stage of EV validation—where everything from battery packs to charging systems is scrutinized before being integrated into vehicles.

The rising complexity of EV components means manufacturers need equipment that can test under extreme conditions—heat, cold, stress, and electromagnetic interference. Increasingly, simulation-based testing and hardware-in-the-loop (HIL) approaches are being adopted to reduce risks and speed up development.

Key Growth Regions: China, India, and Beyond

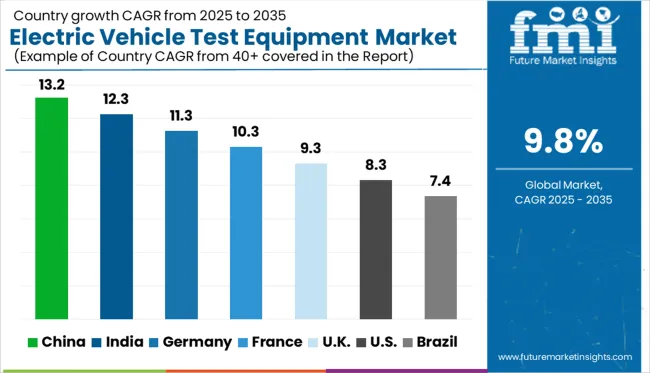

Geography tells another fascinating story. While North America and Europe remain critical players, Asia-Pacific is emerging as the fastest-growing hub for EV test equipment.

- China leads with a projected 13.2% CAGR, supported by its vertically integrated EV ecosystem and massive battery production capacity. Testing demand here extends to battery swap stations and thermal safety validation.

- India follows with a 12.3% CAGR, where testing needs are driven by two-wheelers, e-rickshaws, and light-duty EVs. Government-backed EV clusters are boosting local adoption of test systems.

- Germany (11.3% CAGR) is leveraging its reputation for precision engineering, focusing on advanced test benches for inverters, motors, and charging systems.

- The UK (9.3% CAGR) is seeing traction in testing for commercial fleets and retrofitted EVs.

- The US (8.3% CAGR) shows steady demand from aerospace projects, municipal fleets, and EV startups that need portable testing solutions.

This global spread reflects not just the rise of EVs, but also the decentralized race to build safer, more efficient vehicles across different markets.

The Competitive Landscape: Who’s Powering the Market?

Several companies are at the forefront of this market, providing cutting-edge test systems to automakers and component suppliers.

Key players include:

- National Instruments Corporation

- Intertek Group Plc

- Keysight Technologies, Inc.

- TUV Rheinland

- Durr Group

- AVL

- Chroma ATE

In October 2024, for example, Keysight Technologies expanded its RP7900 series regenerative power systems to support higher voltage EV testing. These systems not only reduce energy consumption by feeding unused power back into the grid but also improve accuracy for testing batteries and drivetrains.

Such innovations show how the industry is moving toward energy-efficient, real-time, and automated testing solutions, keeping pace with the rapid evolution of EVs themselves.

Opportunities Ahead: Flexible, Service-Driven Testing

Beyond traditional sales, new business models are emerging. Subscription-based platforms, leasing programs, and remote diagnostic services are making advanced test systems more accessible to startups and smaller players.

Mobile and portable testing rigs are also on the rise, supporting fleet operators and field validation needs. Meanwhile, partnerships between test equipment makers, labs, and automakers are creating standardized validation protocols—essential for scaling EV production worldwide.

Key Companies

- Profiled National Instruments Corporation

- Intertek Group Plc

- Keysight Technologies, Inc.,

- Tuv Rheinland

- Durr Group

- AVL

- Chroma ATE

As the electric vehicle market races ahead, the global EV test equipment industry is set to nearly triple by 2035—ensuring every battery, motor, and charging system is safe, reliable, and road-ready.

Reference: https://www.futuremarketinsights.com/reports/electric-vehicle-test-equipment-market