In 2024, global adoption of electric vehicles (EVs) and deployment of charging infrastructure continued their steady upward trajectory—even amid lingering geopolitical tensions and macroeconomic uncertainties, reveals the EV Charging Index 2025 by Roland Berger

Rising EV Sales and Regional Disparities

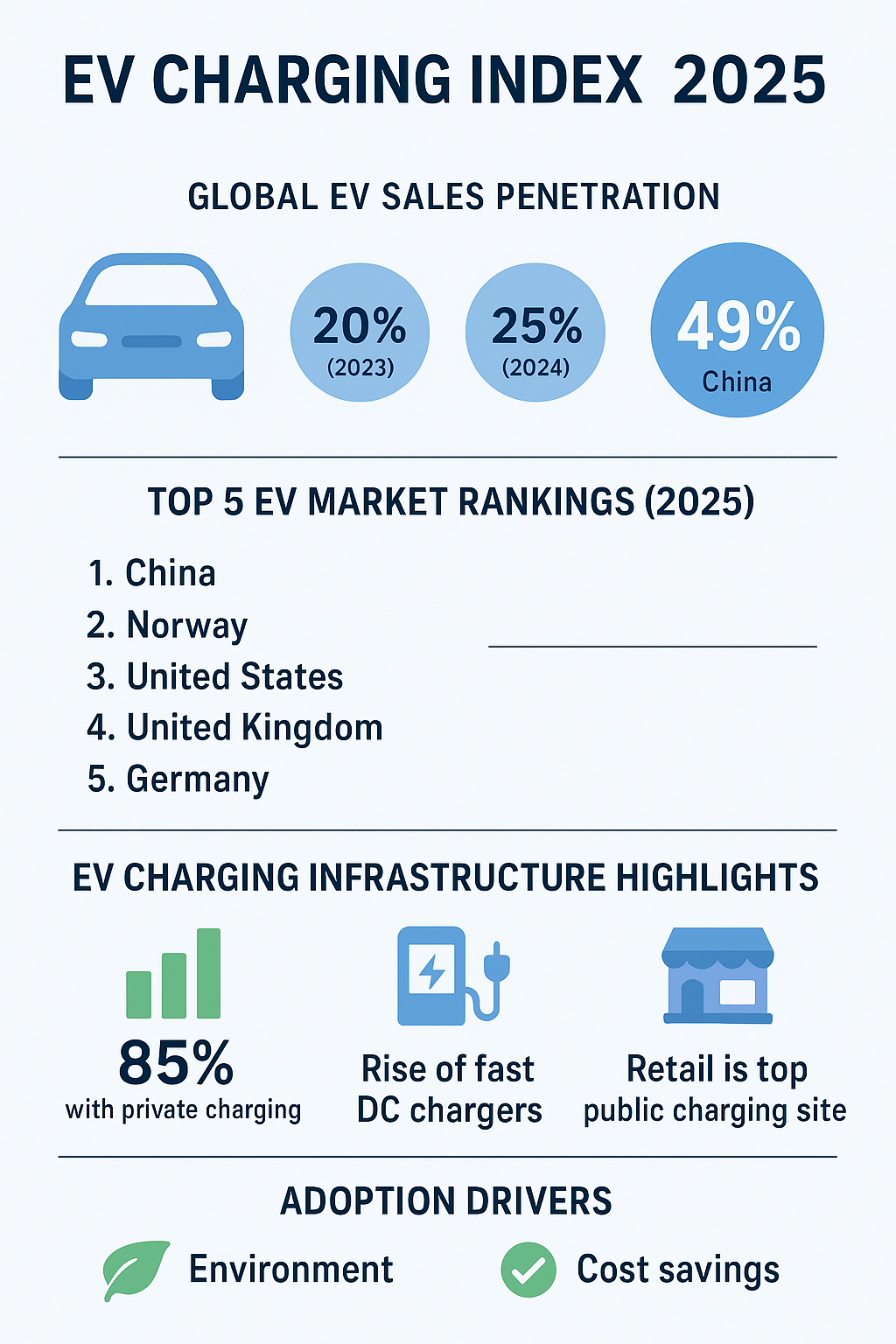

EVs accounted for one in every four vehicles sold globally in 2024, up from one in five the previous year. China led the charge, increasing its EV sales penetration from 36% to 49%, reinforcing its position at the top of the index

Other markets told a more nuanced story. While China boasted rapid progress, growth in mature markets was modest. In contrast, the Middle East, despite rising EV sales, struggled to match this with sufficient charging infrastructure development.

Infrastructure Expansion and User Satisfaction

The sufficiency of public charge points improved across most regions, accompanied by a growing share of fast DC chargers—factors contributing to elevated user satisfaction .This infrastructure expansion remained essential even though 85% of users have access to private or shared home charging, underlining the continued importance of public charging stations—especially at retail locations, which remain EV owners’ top public charging destination.

Overall Market Maturity: Index Scores Rise

Roland Berger’s index covers 33 markets, drawing upon primary research and a survey of 12,000 participants conducted in Q2 2025 . The average global EV Charging Index score jumped from 47 (2022) to 56 (2024), signaling consistent growth across the board the US Rise

Top rankings remain stable, with China firmly in the lead, followed by Norway in second and the United States in third place Confirming this, multiple summaries reinforce the same leaders.

Europe also saw shifts: the UK climbed to fourth place, driven by solid EV sales growth and expanding charging infrastructure. Meanwhile, Portugal and Turkey advanced into the upper half of the rankings . By contrast, Germany fell to fifth place, largely due to declining EV sales following the removal of state subsidies in early 2024, though it continues to expand public charging infrastructure and pilot advanced technologies like vehicle-to-grid (V2G) and battery swapping

Emerging Markets Gain Ground

Younger markets are closing the gap. Southeast Asia (e.g., Thailand and Indonesia), the Middle East, and emerging economies like Brazil and India are demonstrating strong progress—not just in sales, but in infrastructure and customer satisfaction, too

Changing Motivations for EV Adoption

While environmental priorities remain important, lower operating costs and improved performance are becoming equally powerful motivators for EV adoption

Article Summary Table

| Theme | Key Insight |

|---|---|

| EV Penetration | Global sales rose from 20% to 25%, with China surging to 49%. |

| Infrastructure | Public charging sufficiency and DC fast-charger availability improved, boosting user satisfaction. |

| Market Rankings | Top leaders: China → Norway → US; UK advances to 4th; Germany drops to 5th post-subsidy removal. |

| Emerging Markets | Southeast Asian, Middle Eastern, and emerging markets are making significant headway. |

| Adoption Drivers | Lower cost of ownership is now a major motivator alongside environmental concerns. |

Related Market Data – https://www.futuremarketinsights.com/reports/ev-charging-station-market