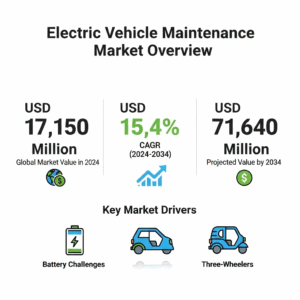

The electric revolution is no longer just about what’s under the hood—it’s about what happens when that hood eventually needs lifting. The global electric vehicle (EV) maintenance market, currently valued at USD 17,150 million in 2024, is projected to soar to an impressive USD 71,640 million, growing at a brisk 15.4% CAGR over the next decade.

As the number of EVs on the road accelerates, so too does the demand for the services that keep them running. For industry players, it’s not just about fixing vehicles—it’s about powering a new era of automotive aftercare.

Why EV Maintenance Is Becoming a Hot Market

At first glance, EVs promise simplicity. With fewer moving parts than their gasoline-powered counterparts, they seem like they should require less attention. But reality is proving more complex.

Recent reports claim EVs face 79% more maintenance issues compared to gas-powered vehicles. From delicate battery systems to specialized electronics, many owners are finding that keeping their EVs road-ready often means relying on expert help rather than DIY fixes.

“Consumers are still adjusting to the learning curve of electric mobility,” notes an industry analyst. “Unlike with traditional cars, many owners aren’t confident tinkering with EV components, so they turn to professional services.”

Battery Challenges at the Core

The heart of every EV—the lithium-ion battery—brings unique challenges. While safer designs are emerging, risks remain. Certain batteries can reignite long after a fire has been put out, creating hazards that require skilled management.

This concern is fueling the demand for specialized maintenance. Battery checks, cooling system monitoring, and software updates are no longer optional—they’re vital for keeping EVs safe and efficient.

Three-Wheelers Lead the Pack

Surprisingly, it’s not just sleek sedans or SUVs fueling the market’s growth. Electric three-wheelers—tricycles, rickshaws, and small trucks—are at the forefront. Nearly half of all three-wheelers on the road today are electric, far outpacing adoption rates for two- and four-wheelers.

Given their popularity in commercial transport, businesses are quick to invest in regular upkeep. After all, a delivery rickshaw or electric cargo truck off the road means lost income. For maintenance providers, this translates into steady, high-volume demand.

Government Push: Charging the Market

From New Delhi to Washington, policymakers are fanning the flames of EV adoption. Tax breaks, subsidies, and emission regulations are giving manufacturers a boost, while indirectly creating a fertile environment for maintenance services.

Take the United States, for example. In January 2024, the U.S. Transportation Department announced nearly USD 50 million in grants to repair or replace EV charging stations. By ensuring charging infrastructure is reliable, the government is indirectly spurring confidence among buyers—and by extension, guaranteeing future work for mechanics and service providers.

The Role of Industry Giants

Legacy automakers aren’t sitting this one out. Industry stalwarts like Suzuki, Hyundai, and others are rapidly expanding into the EV segment. With every new model launched, an entire ecosystem of servicing and repair opportunities follows.

In fact, Hyundai is actively preparing its workforce for this future. The company’s “EV Tech Lab” workshops, launched in Seoul in 2022, are designed to train technicians on specialized EV maintenance.

Where the Money Is: BEVs & Mechanical Parts

When it comes to investment segments, battery electric vehicles (BEVs) dominate. In 2024, BEVs are expected to capture 56.3% of the market share, outpacing hybrids. The reason? Hybrids often require traditional servicing, while BEVs rely solely on electric systems—driving demand for specialized care.

As for what gets serviced most often, it’s not just the batteries. Mechanical components account for 52.2% of service needs. While EVs have fewer moving parts, essentials like brakes, suspension, and steering still demand attention.

Global Outlook: Leaders and Laggards

Growth isn’t evenly distributed worldwide. Some countries are sprinting ahead:

- India: Set to grow fastest, with a staggering 17.9% CAGR through 2034.

- United Kingdom: Expected CAGR of 17.7%, fueled by mass EV adoption, though specialist shortages could hinder growth.

- United States: On track for 17.2% CAGR, supported by infrastructure upgrades.

- China & Germany: Both above 17%, reflecting strong government backing and manufacturing bases.

Meanwhile, markets like Spain (14.2%) and Australia (14.3%) are progressing more slowly, largely due to infrastructure gaps and lower EV penetration.

Key Players Shaping the Future

- Robert Bosch GmbH

- Hyundai Motor Company

- The Hybrid Shop

- HEVRA Europe OU

- YCC Service Center

- RAD AIR COMPLETE CAR CARE

- SK Innovation Co. Ltd

- LKQ Corporation

- Axalta Refinish

as EV adoption surges, the maintenance market isn’t just keeping up—it’s becoming the silent engine driving the future of mobility. The next decade won’t just be about selling EVs, but about keeping them running safely, efficiently, and affordably.

Reference: https://www.futuremarketinsights.com/reports/electric-vehicle-maintenance-market