The race toward electrification is picking up speed, and while sleek car designs and long-range batteries often dominate headlines, there is another quiet hero powering the shift: the DC contactor. These critical components, responsible for ensuring safe high-voltage switching inside electric vehicles (EVs), are becoming a cornerstone of modern mobility. By 2035, the global electric vehicle DC contactor market is forecast to nearly double in size—growing from USD 128.6 million in 2025 to USD 275.1 million, at a 7.9% CAGR.

Industry experts point out that while DC contactors may not grab consumer attention like EV exteriors or charging apps, they are indispensable. “Without advanced contactors, the transition to high-voltage EV systems and ultra-fast charging simply wouldn’t be possible,” says an industry analyst.

Shifting into High Gear:

The second phase of market expansion comes with mainstream EV integration. From USD 128.6 million in 2025 to USD 275.1 million by 2035, growth will be driven by:

- Government incentives and emission mandates pushing EV adoption globally.

- Expansion of fast and ultra-fast charging networks, requiring contactors capable of handling rapid high-voltage switching.

- Innovations such as solid-state switching and digital monitoring for predictive maintenance.

By this stage, DC contactors will evolve from passive switches to smart, connected safety devices—a necessary shift as EVs integrate deeper into digital mobility ecosystems.

Quick Stats

- Market Size (2025): USD 128.6 million

- Forecast Size (2035): USD 275.1 million

- CAGR (2025–2035): 7.9%

- Dominant Segment (2025): High-voltage (>60 V) at 62% market share

- Leading Regions: North America, Asia-Pacific, Europe

- Top Players: ABB, Carlo Gavazzi, Eaton, Fuji Electric, Geya

Why This Market Matters

Despite making up only 2–3% of the overall EV component market, DC contactors are disproportionately vital. In EV safety and power distribution systems, their share rises to 10–12%, underscoring their role in protecting battery packs, enabling fast charging, and ensuring thermal safety.

“Think of contactors as gatekeepers,” explains an EV engineer. “They prevent short circuits, isolate faults, and keep power flowing smoothly. Without them, every EV would carry significantly higher risks.”

Spotlight on Key Segments

- High Voltage (>60 V)

Dominating at 62% share in 2025, this segment is powered by demand for faster charging, higher range, and better acceleration. Heavy-duty EVs and charging networks further amplify this need. - Battery Management Systems (BMS)

Expected to capture 28% of market revenue in 2025, BMS applications rely heavily on contactors for fault isolation, safe start-up, and real-time diagnostics. With larger, more complex battery packs entering the market, BMS-integrated contactors will remain a growth driver.

Growth Drivers and Roadblocks

Key Growth Drivers:

- High-voltage system integration enabling long-range EVs.

- Stricter safety regulations, including ISO 26262 compliance.

- Fast-charging adoption, demanding higher current capacity and durability.

Challenges:

- High material and production costs.

- Ensuring durability under temperature extremes and vibrations.

- Competitive pricing pressures amid rapid innovation.

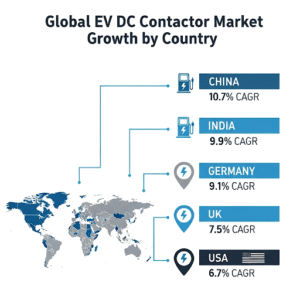

Country-Level Insights

- China leads with a 10.7% CAGR thanks to government backing, giga-factories, and more than 1 million public fast-charging stations by 2029.

- India follows at 9.9% CAGR, driven by two- and three-wheeler EV adoption and localized manufacturing.

- Germany posts 9.1% CAGR, fueled by luxury EVs and 800V platform adoption.

- UK at 7.5% CAGR benefits from zero-emission mandates and charging corridor investments.

- USA grows at 6.7% CAGR, bolstered by tax incentives and fast-charging expansion.

Competitive Landscape

The market is highly competitive, with global giants and emerging specialists shaping innovation.

- ABB leads with robust high-current contactors optimized for both EVs and charging stations.

- Carlo Gavazzi focuses on compact, energy-efficient designs, recently launching its RSLS series solid-state relays for EV charging.

- Eaton leverages its power management expertise to deliver long-life, fault-protected contactors.

- Fuji Electric drives innovation in high-durability designs for fast-charging systems.

- Geya targets cost-sensitive markets with modular, affordable solutions.

Future strategies are focused on miniaturization, solid-state technology, and smart diagnostics—transforming contactors into intelligent safety nodes within EVs.

Key Companies Profiled

- Abb

- Carlo Gavazzi

- Eaton

- Fuji Electric

- Geya

By 2035, DC contactors may no longer be just switches but critical smart systems, enabling EVs to charge faster, drive further, and operate safer. The next decade marks a turning point—not just for EV adoption, but for the small yet powerful components making the journey possible.

Reference: https://www.futuremarketinsights.com/reports/electric-vehicle-dc-contactor-market