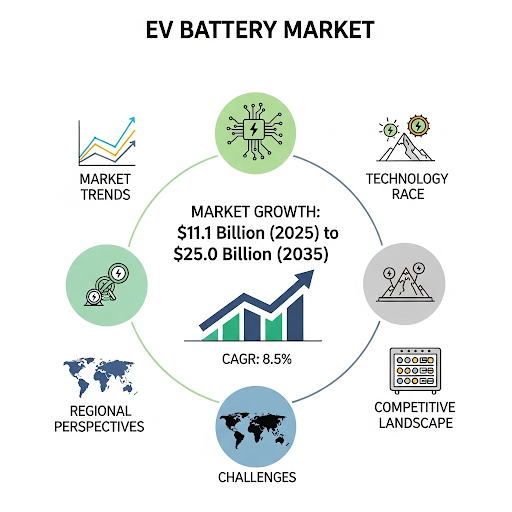

Industry forecasts suggest that the EV battery market will surge from USD 11.1 billion in 2025 to USD 25.0 billion by 2035, representing a compound annual growth rate (CAGR) of 8.5%. Much of this momentum comes from the ongoing shift to electrification, reinforced by government climate mandates, automakers’ aggressive EV rollouts, and a public increasingly willing to swap gasoline for kilowatts.

EV batteries, predominantly lithium-ion, are at the heart of this transition. They power everything from compact urban cars to heavy-duty trucks and buses. Automakers are racing to improve battery performance—seeking higher energy density, faster charging, and safer chemistries—while governments are providing tax breaks, subsidies, and infrastructure investments to push adoption further.

The Technology Race

Battery innovation is moving quickly. The industry is pivoting toward solid-state batteries, known for their safety and energy efficiency, as well as high-nickel chemistries that improve performance. Meanwhile, battery recycling is no longer an afterthought but a necessity, as manufacturers work to secure scarce raw materials like lithium, cobalt, and nickel.

The rise of Battery-as-a-Service (BaaS) models and second-life applications—such as repurposing used batteries for renewable energy storage—also signal a maturing ecosystem where the battery lifecycle extends well beyond the car.

Regional Perspectives

The growth story looks different across continents.

- North America:

The United States is charging ahead with strong government backing, most notably through the Inflation Reduction Act and federal EV tax credits. Automakers like Tesla, GM, and Ford are building gigafactories across the Midwest and Southeast, while recycling startups and solid-state pioneers are beginning to shape the future of U.S. battery innovation. Washington’s push for domestic supply chains is also reducing reliance on overseas producers. - Europe:

The European Union has cemented its leadership with strict emissions targets and its pledge to ban new internal combustion engine (ICE) sales by 2035. Gigafactories by Northvolt, CATL, and ACC are scaling up production, while the European Battery Alliance works to secure local raw material supplies. Recycling and circular economy initiatives are central to Europe’s vision, making sustainability as important as scale. - Asia-Pacific:

Asia remains the beating heart of global EV battery production. China leads with a combination of state subsidies, infrastructure expansion, and powerhouse companies like CATL and BYD. Japan focuses on compact, high-performance batteries, with Toyota and Panasonic pioneering solid-state breakthroughs. South Korea’s giants—LG Energy Solution, SK On, and Samsung SDI—are investing heavily both at home and abroad, pushing innovations in high-nickel and cobalt-free chemistries. - Rest of the World:

Latin America is set to emerge as a critical supplier of raw materials, particularly lithium from the “Lithium Triangle” of Chile, Argentina, and Bolivia. The Middle East and Africa are slower to electrify but are investing in infrastructure and eyeing opportunities to diversify beyond fossil fuels.

Opportunities and Hurdles

The opportunities are massive, but challenges loom large.

- Cost remains a barrier. While battery prices have dropped sharply over the past decade, they still account for up to 40% of an EV’s price tag. Scaling production and adopting new chemistries could help drive costs below the crucial USD 70/kWh threshold, enabling mass-market parity with gasoline cars.

- Raw material supply chains are strained. Growing demand for lithium, nickel, and cobalt has sparked both geopolitical competition and environmental concerns. Recycling will be key to easing supply bottlenecks, but it requires scaling infrastructure that remains in its infancy.

- Sustainability is under scrutiny. Ethical sourcing, particularly around cobalt mining, and the environmental footprint of battery production are becoming pressing issues. Companies that can prove their sustainability credentials are expected to gain favor with regulators and consumers alike.

Market Shifts from 2020 to 2035

Between 2020 and 2024, the industry focused on driving down costs and scaling lithium-ion production. By 2025, the next phase begins—defined by advanced chemistries, expanded applications, and a growing role for recycling. From passenger cars and SUVs to commercial vehicles, two-wheelers, and even marine applications, EV batteries are no longer confined to a niche.

Competitive Landscape

The global EV battery market is highly consolidated, with a few players dominating.

- CATL (China) leads with a 30–35% market share, supplying Tesla, BMW, and Hyundai, and investing heavily in sodium-ion and solid-state research.

- LG Energy Solution (South Korea) follows with 20–25%, partnering with GM and Ford, and expanding its footprint in Europe and North America.

- Panasonic (Japan), supplying Tesla’s Nevada Gigafactory, remains a strong player in cylindrical battery technology.

- BYD (China) has carved out a stronghold with its Blade Battery, a safer and longer-lasting LFP design.

- Samsung SDI (South Korea) specializes in premium EVs and hybrids, with prismatic and pouch cells designed for performance and longevity.

Other Key Players

- Contemporary Amperex Technology Co. Ltd

- LG Energy Solution

- Panasonic Holdings Corporation

- SK On (SK Innovation)

- AESC (Envision Group)

- Northvolt AB

- Farasis Energy

- CALB (China Aviation Lithium Battery)

- SVolt Energy Technology

With breakthroughs in solid-state technology, recycling solutions, and global investments, the EV battery market is poised to redefine the future of clean mobility. For businesses and investors, the next decade represents opportunity to power the electric revolution.

Reference: https://www.futuremarketinsights.com/reports/electric-vehicle-battery-market