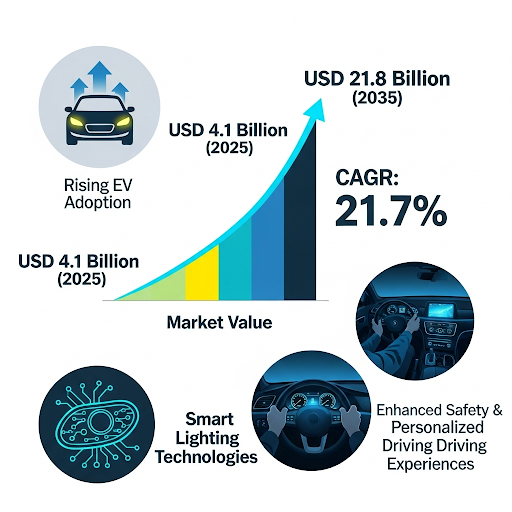

The global electric vehicle (EV) lighting market is set for a decade of unprecedented growth, with its value forecasted to rise from USD 4.1 billion in 2025 to USD 21.8 billion by 2035, marking a striking CAGR of 21.7%. This surge is powered by rising EV adoption, smart lighting technologies, and consumer demand for safer and more personalized driving experiences.

Lighting Becomes a Defining Feature of EV Design

In the age of electrification, lighting is no longer a secondary accessory—it has become a signature design element and a vital component of safety and energy efficiency. Automakers are embedding advanced lighting into EV platforms not only to illuminate the road but also to differentiate brand identity.

Take Hyundai’s IONIQ 5, for example. Its “Parametric Pixel” LED lighting doubles as a futuristic brand marker and an engineering solution that boosts visibility and efficiency. This trend reflects a broader industry shift: lighting is now at the intersection of style, safety, and sustainability.

Intelligent Lighting Expands Beyond Vehicles

It’s not only cars benefiting from smart lighting. Charging stations worldwide are adopting LED-based lighting systems with smart controls to improve nighttime usability and energy savings. Features such as motion-triggered illumination and automatic brightness regulation have already been rolled out, showcasing how EV lighting solutions extend into the wider ecosystem of e-mobility.

LED Technology Leads the Pack

Among all lighting types, LED lighting is expected to dominate, making up around 72% of the global EV lighting market by 2025, and growing at a 22.0% CAGR through 2035.

Why LEDs? Their energy efficiency, compact design, long lifespan, and low heat output make them the ideal solution for EVs, where every watt of saved energy translates into better battery performance. Automakers continue to integrate LEDs for headlamps, daytime running lights (DRLs), brake lights, and interior ambient lighting.

As adaptive LED matrices, intelligent beam-shaping, and connected lighting become mainstream, LED technology is set to remain the backbone of EV lighting innovation for years to come.

Passenger Cars Drive Demand

Passenger EVs are expected to hold a 63% share of the market in 2025, expanding at a 21.9% CAGR through 2035. This dominance is attributed to rising consumer adoption, supportive regulations, and diverse model availability.

From hatchbacks to luxury sedans, EV manufacturers are prioritizing advanced lighting systems to enhance both aesthetics and functionality. Features such as sequential turn indicators, customizable ambient lighting, and adaptive high beams are no longer exclusive to high-end models; they are becoming standard across a wider range of vehicles.

What Buyers Value: Safety, Efficiency, and Design

Original equipment manufacturers (OEMs) and customers alike are placing a high value on energy efficiency. Lighting solutions must strike the right balance between performance, durability, and cost.

For OEMs, design innovation and regulatory compliance are top priorities. Aftermarket suppliers, however, focus more on cost efficiency, while retailers and consumers lean towards value and aesthetics. This variation reflects the diverse decision-making drivers across the EV lighting ecosystem.

Risks and Challenges: Supply Chains and Regulation

Despite its promising growth, the EV lighting market faces risks. With 78% penetration of LED technology, supply chains are heavily reliant on global chip availability. Semiconductor shortages have already disrupted LED driver supplies, leading to higher costs and production delays.

Regulatory complexities also loom large. Different safety standards across regions slow down adoption rates. For instance, matrix LED technology has faced sluggish uptake in the U.S. compared to Europe, highlighting how inconsistent policies can impact innovation.

Premium vs. Budget Pricing

Lighting strategies differ by market segment. Luxury EVs use dynamic LED projector lights, AI-powered headlights, and customizable ambient lighting—allowing automakers to bundle these features into premium packages. On the other hand, budget EVs prioritize basic LED modules for affordability, relying on penetration pricing strategies to remain competitive.

As LED component costs continue to fall, manufacturers are leveraging upselling opportunities—offering consumers the option to pay extra for personalized lighting features, creating a new avenue for profitability.

Regional Outlook: Where Growth Will Accelerate

- United States (CAGR 7.6%): Growth is fueled by EV adoption, federal incentives like the Inflation Reduction Act, and automakers like Tesla and Ford rolling out matrix LED and adaptive lighting systems.

- United Kingdom (CAGR 7.2%): Driven by a ban on petrol/diesel cars by 2035 and strong luxury EV demand, with Bentley and Jaguar Land Rover leading in adaptive LED integration.

- European Union (CAGR 7.8%): Regulatory frameworks such as the EU Green Deal push for advanced OLED and laser lighting technologies. Germany, France, and the Netherlands are leading adoption.

- Japan (CAGR 7.5%): Toyota, Honda, and Nissan are spearheading OLED and matrix LED systems in line with Japan’s 2050 carbon neutrality plan.

- South Korea (CAGR 7.9%): Hyundai and Kia are pioneering AI-powered pixel LED systems, while the government targets 33% EV penetration by 2030.

Competitive Landscape: Innovation Defines Leadership

Tier-1 automotive lighting giants like Hella, Valeo, Koito Manufacturing, Stanley Electric, and Marelli are strengthening OEM collaborations to stay ahead. Their focus: LED, OLED, adaptive headlamps, and customizable interior lighting.

At the same time, start-ups and new entrants are shaking up the market with AI-enabled lighting controls, ultra-thin OLED panels, and advanced matrix LED solutions.

The future of EV lighting will hinge on sustainability, autonomous-driving compatibility, and personalized user experience—all areas where innovation will separate the leaders from laggards.

Key Market Players

- Denso Corporation

- Hella GmbH

- Hyundai Mobis

- Koito Manufacturing

- Koninklijke Philips N.V.

- Osram GmbH

- Robert Bosch GmbH

- Stanley Electric Co.

- Valeo

- ZKW

Related Market Data: https://www.futuremarketinsights.com/reports/ev-lighting-market