The way people move around cities is undergoing a quiet revolution. What was once a novelty—zipping through crowded streets on a slim, battery-powered scooter—has now become a mainstream solution to one of the 21st century’s biggest urban challenges: how to move quickly, cheaply, and sustainably in increasingly crowded spaces.

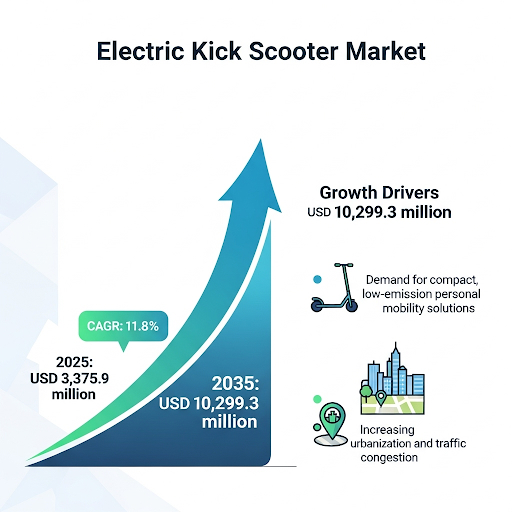

According to new market research, the global electric kick scooter (EKS) market is projected to expand from USD 3.37 billion in 2025 to USD 10.29 billion by 2035, growing at a strong 11.8% compound annual growth rate (CAGR). This impressive trajectory reflects not only consumer demand but also broader government, corporate, and cultural shifts toward clean mobility.

Why E-Scooters Are Gaining Ground

The appeal of electric kick scooters lies in their simplicity and adaptability. In densely populated cities, where traffic congestion can cost commuters hours every week, scooters offer a nimble alternative. For trips too short for a car but too long for walking, they are emerging as a sweet spot for last-mile connectivity.

Governments are increasingly supportive. Many cities are designating protected lanes, charging points, and low-speed zones, while clamping down on high-emission vehicles. This policy alignment is accelerating the adoption of micro-mobility solutions, from rental fleets to personal purchases.

Consumer behavior is also shifting. With urban lifestyles demanding speed and flexibility, individuals are investing in their own e-scooters. In fact, personal use already accounted for 61% of the market in 2025, and this share is expected to expand steadily over the next decade.

Challenges: Rules, Risks, and Regulations

Yet the industry is not without hurdles. The lack of standardized regulations is slowing growth in many regions. Cities impose varying speed limits, parking restrictions, and operational rules, leading to confusion among both riders and operators.

Safety is also a lingering concern. Reports of accidents, unsafe riding in pedestrian zones, and battery-related fire incidents have prompted calls for stricter design and compliance standards. Policymakers and manufacturers alike will need to prioritize these issues to sustain public trust.

Opportunities Ahead: Smart Mobility and Sharing Models

Despite challenges, opportunities are immense. Advances in battery technology are making scooters lighter, longer-lasting, and faster to charge. The rise of smart mobility ecosystems, where scooters integrate seamlessly with buses, trains, and ride-hailing apps, is reshaping urban transport.

Shared e-scooter services are thriving. Companies like Bird, Lime, and Tier have already woven scooters into city life, offering quick, app-based rentals that complement public transport networks. As more cities invest in smart infrastructure, micro-mobility solutions will only grow stronger.

Regional Growth Outlook

The adoption of e-scooters is not uniform. Growth rates vary depending on infrastructure, policy, and consumer readiness.

- United States – Driven by expanding bike lanes and services from Bird and Lime, the U.S. market is forecast to grow at a CAGR of 11.5%. Personal ownership is also surging, particularly among younger urban commuters.

- United Kingdom – With 11.6% CAGR, the UK is embracing e-scooter rentals under government-backed pilot schemes. Rising last-mile delivery use cases are further boosting demand.

- European Union – At the forefront of sustainability, the EU market is projected to grow 12.0% annually, with Paris, Berlin, and Madrid leading adoption through incentives and infrastructure investment.

- Japan – Recent regulatory changes have legalized e-scooters in urban areas, opening the door for growth at 11.4% CAGR. Tech-savvy riders are drawn to GPS-enabled and AI-secured models.

- South Korea – Backed by strong battery manufacturers and government incentives, South Korea’s market is expected to climb 11.9% annually, driven by young consumers and booming ride-sharing platforms.

Competitive Landscape: Who’s Leading the Charge

The electric kick scooter market is dynamic, with established players and emerging disruptors competing for global share.

- Micro Mobility Systems AG (18–22%): Known for premium foldable scooters, the company emphasizes safety and sustainability.

- Golabs Inc. (15–19%): Offers cost-effective, high-performance scooters for both rental and personal use.

- Bird Rides Inc. (12–16%): A leader in large-scale rental fleets, Bird focuses on AI-driven fleet management and sustainability.

- Segway Inc. (8–12%): A pioneer in smart, connected scooters with app integration and advanced safety features.

- IconBIT Limited (6–10%): Specializes in budget-friendly, compact scooters, catering to entry-level users in Europe and Asia.

Other key players include NIU Technologies, Xiaomi, Apollo Scooters, Razor USA, and Dualtron (MiniMotors)—each carving out niches from affordable models to high-performance machines.

Company Profile

- Micro Mobility Systems AG

- Golabs Inc.

- Bird Rides Inc.

- Segway Inc.

- IconBIT Limited

- GOVECS AG

- Razor LLC

- Xiaomi Corporation

- YADEA Technology Group Co. Ltd.

- AKTIVO Scooter

Related Market Data: https://www.futuremarketinsights.com/reports/electric-kick-scooter-market