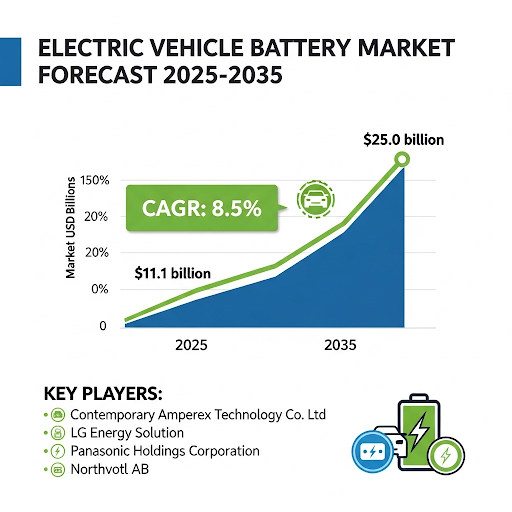

The race toward clean mobility is accelerating, and at the heart of this transformation lies one critical component: the electric vehicle (EV) battery. Between 2025 and 2035, the global EV battery market is projected to surge from USD 11.1 billion to USD 25.0 billion, achieving a compound annual growth rate (CAGR) of 8.5%. This growth reflects not only the increasing popularity of electric cars but also the world’s determination to cut carbon emissions and embrace a sustainable future.

The Engine Behind Electrification

EV batteries—dominated by lithium-ion chemistries—power everything from compact two-wheelers to heavy trucks and buses. Governments worldwide are pushing for carbon neutrality through tax incentives, zero-emission mandates, and subsidies for EV adoption. At the same time, consumers are becoming more receptive to EVs as costs fall and charging infrastructure expands.

Battery manufacturers are working intensively on three fronts:

- Boosting energy density to deliver longer driving ranges.

- Reducing charging time to improve convenience.

- Enhancing safety and thermal management to reassure customers.

Emerging technologies such as solid-state batteries, high-nickel cathodes, and recycling solutions are reshaping the industry. Concepts like Battery-as-a-Service (BaaS) and second-life energy storage applications are opening new opportunities beyond transportation.

Regional Outlook: Who Leads the Charge?

North America

The United States is placing itself firmly on the EV map with ambitious federal policies. The Inflation Reduction Act (IRA) has spurred domestic battery production, reducing reliance on imports and creating jobs through gigafactories built by Tesla, GM, and Ford. With the Biden administration’s push for clean energy, North America is experiencing one of the fastest EV adoption rates globally.

Battery recycling startups and solid-state R&D companies are also gaining traction, signaling a future where America could become both a producer and recycler of high-value energy storage systems.

Europe

Europe remains a front-runner thanks to its strict climate policies and commitment to end sales of new internal combustion engine (ICE) vehicles by 2035. The European Green Deal has accelerated EV adoption across Germany, France, and the UK, while local manufacturers such as Northvolt and ACC are scaling domestic battery supply chains.

The region also emphasizes ethical and sustainable sourcing, setting high ESG standards. Recycling and circular economy models are already central to Europe’s EV battery strategy, making the continent a benchmark for sustainable mobility.

Asia-Pacific

Asia-Pacific is the undisputed leader in EV battery production, with China dominating both manufacturing and raw material supply. Generous subsidies, large-scale urban EV rollouts, and technology leadership from companies like CATL and BYD have given China a commanding share of the market.

Meanwhile, Japan continues to spearhead solid-state battery R&D, with Toyota and Panasonic leading the charge. South Korea, home to LG Energy Solution, Samsung SDI, and SK On, is focusing on high-nickel and cobalt-free technologies while expanding overseas to meet localization requirements in North America and Europe.

Rest of the World

Regions such as Latin America, the Middle East, and Africa are still emerging but show strong potential. Latin America is rich in lithium reserves, positioning it as a key player in global supply chains. The Middle East is investing in EV adoption to diversify from oil, while African nations are beginning to embrace EVs as infrastructure improves.

Challenges Ahead

Despite impressive momentum, the EV battery industry faces hurdles:

- High costs – Batteries remain the most expensive component of an EV, limiting affordability in many markets.

- Raw material supply risks – Mining of lithium, cobalt, and nickel raises environmental and ethical concerns.

- End-of-life management – Recycling old batteries efficiently remains an industry-wide challenge.

These obstacles underscore the need for innovation, sustainable mining, and investment in closed-loop supply chains.

Opportunities Driving Growth

- Next-Generation Technologies – Solid-state and lithium-sulfur batteries promise higher energy density, faster charging, and improved safety.

- Battery Recycling & Second-Life Use – Repurposing EV batteries for grid storage can reduce waste and stabilize renewable energy integration.

- Expansion of Charging Infrastructure – More fast-charging networks worldwide will accelerate EV adoption, directly fueling battery demand.

Market Shift: 2020 to 2035

Between 2020 and 2024, EV batteries were largely lithium-ion (NMC and LFP) based, with costs gradually declining. By 2025–2035, the shift will be toward solid-state, lithium-sulfur, and sodium-ion chemistries, with costs expected to fall below USD 70/kWh, enabling mass-market adoption.

Regulations will become stricter, recycling will be mandatory, and applications will expand beyond cars to marine transport, grid energy storage, and commercial EV fleets.

Country Spotlights

- United States (CAGR: 8.7%) – Gigafactories, IRA incentives, and strong consumer adoption will drive rapid growth.

- European Union (CAGR: 8.6%) – ICE bans, Green Deal targets, and circular economy practices strengthen battery sovereignty.

- Japan (CAGR: 8.2%) – Global leader in solid-state R&D with a focus on compact, long-range batteries for urban mobility.

- South Korea (CAGR: 8.6%) – Home to global OEM suppliers, expanding gigafactory footprint overseas to meet local sourcing demands.

Segmentation Highlights

- By Capacity:

- Under 20 kWh – Popular in scooters, motorcycles, and compact city EVs.

- 21–40 kWh – Dominant in small to mid-sized cars for daily commuters.

- By Vehicle Type:

- Passenger cars lead global demand, supported by consumer interest and government incentives.

- Light commercial vehicles (LCVs) are rapidly adopting EV batteries to meet e-commerce-driven last-mile delivery needs.

Competitive Landscape

The EV battery market is intensely competitive, with a few giants holding the majority share:

- CATL (30–35%) – The global leader, supplying Tesla, BMW, and Hyundai; expanding into sodium-ion and solid-state technologies.

- LG Energy Solution (20–25%) – Key supplier for GM, Ford, and Hyundai; investing heavily in recycling and sustainable chemistries.

- Panasonic (12–16%) – Long-standing partner with Tesla, specializing in cylindrical cells and next-gen cobalt-free designs.

- BYD (10–14%) – Known for its Blade Battery; vertically integrated with both EVs and batteries.

- Samsung SDI (8–12%) – Focused on premium EVs with prismatic and pouch cells; advancing solid-state research.

Other important players include SK On, Northvolt, AESC, CALB, SVolt, and Farasis Energy, all contributing to a dynamic and innovative landscape.

Key Players

- Contemporary Amperex Technology Co. Ltd

- LG Energy Solution

- Panasonic Holdings Corporation

- SK On (SK Innovation)

- AESC (Envision Group)

- Northvolt AB

- Farasis Energy

- CALB (China Aviation Lithium Battery)

- SVolt Energy Technology

The EV battery market between 2025 and 2035 is not just about powering cars—it’s about powering a sustainable future. With innovation, policy support, and consumer adoption aligning, the decade ahead will redefine mobility and reshape the global energy landscape.

Related Market Data: https://www.futuremarketinsights.com/reports/electric-vehicle-battery-market