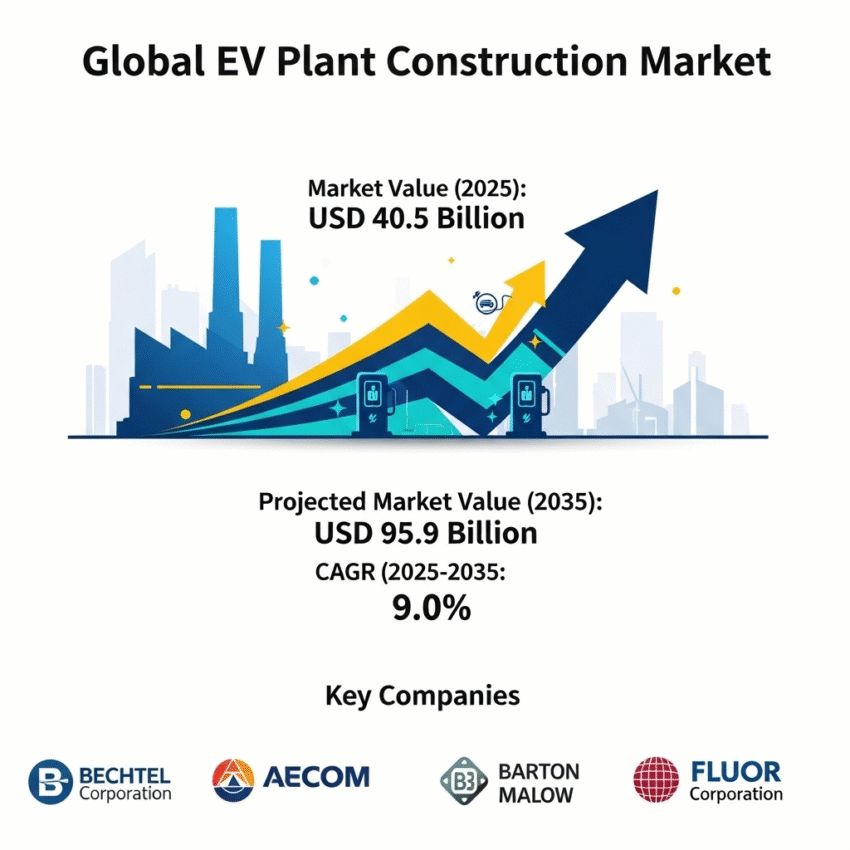

The global electric vehicle (EV) plant construction market is accelerating at an unprecedented pace, driven by the surging demand for electric vehicles, supportive government policies, and the automotive industry’s transition toward sustainable mobility. According to recent market forecasts, the EV plant construction market is expected to grow from USD 40.5 billion in 2025 to USD 95.9 billion by 2035, representing a robust CAGR of 9.0%.

Early Adoption Set the Stage for Growth

During the early adoption phase from 2020 to 2024, the EV plant construction market grew from USD 26.3 billion to USD 37.2 billion. This growth was largely fueled by automakers and industrial players investing in pilot facilities to test scalable production capabilities. Government incentives, emission regulations, and rising consumer demand for EVs encouraged early development. However, the market also faced hurdles, including high capital costs, technological uncertainties, and complex supply chains.

Market Drivers and Growth Factors

The rapid electrification of mobility is the primary driver of the EV plant construction market. Governments and private companies are allocating capital toward capacity expansion, localization of battery and drivetrain production, and smart, sustainable factory models.

The global shift away from internal combustion engines has also triggered a race to scale dedicated EV facilities. Increased funding through green bonds, government subsidies, and public-private partnerships is accelerating project timelines and enabling modular plant rollouts. OEMs are increasingly adopting vertical integration, producing core EV components in-house to secure supply chains and reduce dependency on third parties.

Segmental Insights

By Type: Assembly plants are projected to hold 39.7% of total revenue in 2025, making them the leading facility type. These plants integrate battery packs, electric drivetrains, and advanced electronic systems to optimize production cycles. Modular layouts, automation readiness, and energy-efficient designs further enhance their appeal.

By Construction Type: New plant construction leads the market with 48.1% of revenue in 2025. Greenfield investments allow manufacturers to adopt Industry 4.0 principles, including real-time automation, predictive maintenance, and energy optimization. New constructions are preferred over retrofits, offering operational flexibility, sustainability, and seamless integration of advanced technologies.

By End User: Automakers dominate the market, contributing 42.5% of total revenue in 2025. The transition from internal combustion to electric vehicles necessitates dedicated facilities for battery integration, robotic assembly, and lightweight material handling. In-house plant development ensures production autonomy, localized employment, and alignment with ESG standards.

Key Trends Shaping the Market

- Integrated Battery and Powertrain Production: Modern EV plants increasingly combine vehicle assembly with battery and drivetrain manufacturing, enhancing operational efficiency and reducing logistics costs.

- Modular and Scalable Plant Designs: These designs allow manufacturers to expand capacity without major overhauls, ensuring flexibility for future EV production growth.

- Strategic Partnerships: Automakers are partnering with construction firms, technology providers, and equipment suppliers to accelerate plant construction while ensuring compliance with safety and environmental regulations.

Regional Insights

- China: Leading the market with a 12.2% growth rate, driven by government incentives, renewable energy policies, and large-scale EV production initiatives. Strategic site planning and integration with supply chains reduce operational costs and boost efficiency.

- India: Projected growth at 11.3%, supported by government schemes, rising domestic EV demand, and sustainable plant designs. Public-private partnerships foster technology transfer and innovation.

- Germany: Growth of 10.4%, fueled by green industrial policies, battery manufacturing, and advanced automotive infrastructure. Modular plant designs and automation enhance adaptability.

- United Kingdom: Expansion at 8.6%, driven by government incentives, renewable energy integration, and modular plant designs allowing future scalability.

- United States: Growth of 7.7%, supported by federal incentives, energy-efficient designs, and collaborations with global EV manufacturers to enhance technology adoption.

Future Outlook

Looking ahead, the EV plant construction market is set for remarkable growth as global demand for electric vehicles continues to rise. With advances in modular plant designs, integrated battery and powertrain production, and sustainable construction practices, manufacturers are better equipped to scale operations efficiently.

Key Companies Profiled

- Bechtel Corporation

- AECOM

- Barton Malow

- Fluor Corporation

- Jacobs Engineering

- Shimizu Corporation

- Skanska

- Turner Construction

- WSP

- Yates Construction

strategic investments and sustainable innovations, the EV plant construction market is set to power the future of electric mobility. As demand for EVs accelerates globally, robust and scalable production facilities will remain the backbone of this industry’s growth.

Related Market Data: https://www.futuremarketinsights.com/reports/ev-plant-construction-market