The global shift toward sustainable mobility is reshaping not just the way we drive but also the components that make electric vehicles (EVs) safer and more efficient. One such unsung hero of the EV revolution is the battery housing—a structure that protects, cools, and integrates the battery pack into the vehicle.

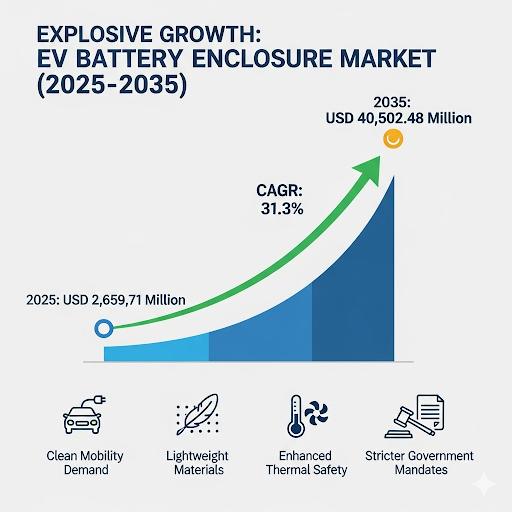

According to market forecasts, the Electric Vehicle (EV) Battery Housing Market is poised for explosive growth over the next decade. Valued at USD 2,659.71 Million in 2025, it is expected to skyrocket to USD 40,502.48 Million by 2035, registering a remarkable CAGR of 31.3%.

This surge reflects more than just the rising number of EVs on the road. It highlights broader industry trends such as the demand for lightweight materials, enhanced thermal safety, and stricter government mandates for clean transportation.

Why Battery Housing Matters

While EV enthusiasts often talk about battery capacity and charging speed, the battery housing plays a crucial but often overlooked role. It acts as a fortress—shielding cells from crashes, heat, moisture, and environmental hazards. At the same time, housings are becoming part of modular vehicle designs that allow manufacturers to scale up production efficiently.

Traditionally, housings were made of iron. But the shift toward aluminum, carbon composites, and high-performance polymers is transforming the landscape. These lighter materials improve driving range, enhance thermal management, and make vehicles more sustainable by being easier to recycle.

Regional Outlook: Who’s Leading the Charge?

North America

North America is experiencing a wave of investment in EV infrastructure. In the U.S. and Canada alone, over USD 1 billion has been poured into EV manufacturing plants this year. These facilities are not just producing batteries but also developing the housings that keep them safe.

Government initiatives, including the Inflation Reduction Act, are incentivizing a domestic supply chain for EV components. Meanwhile, U.S. gigafactories are fueling demand for advanced metallic housings that combine reliability with recyclability.

Europe

Europe remains the frontrunner in EV adoption thanks to strict emissions regulations and generous incentives for consumers. Cities across the continent are phasing out internal combustion engines, forcing automakers to embrace electrification at an unprecedented pace.

Countries like Germany, France, and those in the Nordic region are investing heavily in lightweight materials such as carbon fiber composites. The focus here is not only on performance but also on environmental sustainability, with R&D pushing for fire-retardant and fully recyclable housings.

Asia Pacific

Holding more than 30% of the global EV battery housing market, Asia Pacific is the powerhouse of production. China, Japan, and South Korea lead in manufacturing and innovation, supplying housings compatible with multiple cell formats.

China’s aggressive EV policies have created rapid adoption of both metallic and polymer housings. Meanwhile, Japan and South Korea are pioneering solutions for advanced cooling and modular battery enclosures. India, too, is emerging with demand for cost-effective housings suited to smaller, urban-friendly EVs.

Challenges and Opportunities

Like any fast-growing industry, the EV battery housing market faces its share of hurdles:

- Thermal Management and Safety: Battery housings must manage heat effectively to prevent fire hazards while ensuring crash safety. Finding materials that strike the right balance of lightweight durability and insulation remains a challenge.

- High Production Costs: Advanced materials like aluminum and composites are expensive. Additional costs come from sealing systems and moisture-proofing, which can push housings out of reach for low-cost EV models.

Yet, these challenges also create opportunities:

- Government Incentives: Global policies promoting clean energy are encouraging local supply chains and subsidizing R&D in sustainable housings.

- Material Innovation: Advances in composites, polymers, and smart housings with integrated cooling systems promise safer, cheaper, and greener solutions.

Looking Back: 2020–2024 vs. Looking Ahead: 2025–2035

Between 2020 and 2024, the industry focused on aluminum and steel housings to meet rising EV demand and comply with safety standards.

But the next decade will look very different. From 2025 to 2035, expect:

- Widespread use of composites and polymers to reduce weight.

- Smart housings with IoT-enabled sensors for monitoring heat and impacts.

- Greater collaboration between automakers, battery suppliers, and material science companies.

- Closed-loop recycling systems to support carbon reduction goals.

Country-Level Highlights

- United States: Driven by EV adoption and federal support, expected CAGR of 13.7%.

- United Kingdom: Government’s 2035 carbon neutrality deadline accelerates adoption, CAGR 13.5%.

- European Union: EV leader with strict regulations, CAGR 13.0%.

- Japan: Focus on high-performance housings with advanced cooling, CAGR 13.1%.

- South Korea: Strong R&D ecosystem for next-gen housings, CAGR 13.3%.

Segmentation Outlook

- By Material: Metallic housings will continue to dominate with a projected 61.4% market share in 2025, thanks to their strength and recyclability. Aluminum, in particular, remains popular for balancing lightweight design with safety.

- By Application: Passenger vehicles will drive demand, accounting for nearly 70% of the market in 2025 as urbanization and consumer EV adoption surge.

Competitive Landscape

The market is fragmented yet competitive, with a mix of global giants and emerging innovators.

- Novelis Inc. (14–18% share): Specializes in lightweight aluminum enclosures with recyclability focus.

- Nemak S.A.B. de C.V. (12–16%): Known for hybrid housings combining aluminum and high-strength steel.

- Constellium SE (10–14%): Provides thermal-efficient aluminum solutions.

- Gestamp Automoción S.A. (8–12%): Develops multi-material housings with strong crash performance.

- Minth Group Ltd. (6–10%): Expanding presence in Asia Pacific with cost-effective housings.

Other key players like Thyssenkrupp, Magna International, Hitachi Astemo, Hanwha Advanced Materials, and Inoac Corporation are also ramping up innovation.

Company Profile

- SGL Carbon SE

- Novelis Inc.

- Constellium SE

- Nemak, S.A.B. de C.V.

- GF Linamar LLC

- Minth Group

- ThyssenKrupp AG

- Hitachi Metals, Ltd.

- POSCO

- Norsk Hydro ASA

The Electric Vehicle Battery Housing Market is entering a transformative decade, driven by lightweight materials, advanced safety features, and strong policy support. With global demand accelerating, industry leaders and innovators are set to redefine EV efficiency and sustainability.

Related Market Data: https://www.futuremarketinsights.com/reports/electric-vehicle-battery-housing-market