The global automotive industry is in the middle of a transformation, and at the heart of this shift lies a crucial component: the electric vehicle (EV) motor. From powering small city hatchbacks to luxury SUVs and high-performance sedans, these motors are silently but powerfully driving the clean mobility revolution.

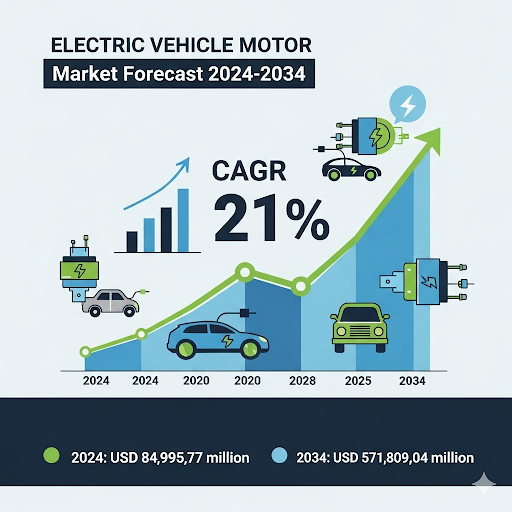

According to the latest industry outlook, the global electric vehicle motor market is projected to grow from USD 84.99 billion in 2024 to an astounding USD 571.80 billion by 2034, registering a 21% compound annual growth rate (CAGR). Put simply, this market is set to multiply nearly sevenfold in just a decade.

But what’s fueling this rapid expansion? Let’s break down the forces behind the surge, the hurdles that remain, and which countries are leading the charge.

Why Electric Vehicle Motors Are in the Spotlight

Governments around the world are tightening emission regulations, compelling automakers to seek alternatives to traditional combustion engines. Electric vehicles, powered by advanced motors, have emerged as the clear solution.

Key factors boosting demand include:

- Stricter emission laws: Automakers must comply with tougher standards, pushing investment in electric propulsion systems.

- Better battery tech: Lower costs and faster charging have made EVs more affordable and practical.

- Innovation in motor design: Automakers like BMW are challenging old norms by introducing AC synchronous motors with brushed current excitation, once thought impractical.

- Heavy R&D investments: Companies are pouring resources into AI-driven systems, smart charging, and connected vehicle technology.

- Strategic alliances: Partnerships between motor manufacturers and automakers are accelerating integration of cutting-edge systems.

The result? EVs are no longer niche vehicles. They are mainstream contenders for city commuters, highway drivers, and even performance enthusiasts.

A Look Back: How We Got Here

The story of EV motors has been one of resilience and growth. In 2019, the market was valued at just USD 33.37 billion. Despite pandemic-related challenges, it nearly doubled to USD 70.17 billion by 2023, growing at 20.1% CAGR.

Governments played a huge role in this acceleration. China, for example, invested USD 600 billion to promote EV adoption, while India removed certain restrictive regulations to keep EV costs in check. These policies not only boosted sales but also encouraged companies to innovate faster.

Opportunities and Hurdles Ahead

The future is bright, but not without its challenges.

- Opportunities:

- AC synchronous motors are gaining traction, offering efficiency and durability.

- Demand for high-powered motors (200 kW and above) is rising, with this segment already accounting for over 36% of market share in 2024.

- Luxury EVs are pushing boundaries, creating a ripple effect across the broader industry.

- Challenges:

- EV motors are long-lasting, often running 15–20 years, which limits aftermarket replacement sales.

- In cost-sensitive markets, high prices and maintenance costs still deter mass adoption.

As the industry moves forward, striking a balance between affordability and technological advancement will be key.

The Global Hotspots: Who’s Leading the Race?

The electric vehicle motor boom is not evenly spread. Some regions are surging ahead thanks to strong policies, consumer demand, and industrial investment.

- United States (20.2% CAGR):

The U.S. controls 91% of North America’s EV motor market, though it’s losing some share to faster-growing Asian nations. With advanced research hubs and favorable regulations, the U.S. remains a vital player in the industry’s future. - United Kingdom (20.9% CAGR):

The UK is emerging as Europe’s most lucrative EV motor market. Backed by national EV sales targets and city-level air-quality mandates, the country is seeing a surge in both sales and domestic production. - Germany (20.1% CAGR):

Known for luxury automakers, Germany is leaning heavily into EVs. Generous subsidies—up to USD 9,781 for all-electric models—are fueling growth, with EV motor sales expected to rise 6.2x by 2034. - Japan (22.7% CAGR):

Japan is the fastest-growing market, driven by giants like Toyota and Honda. Expanding production capacity and strong demand for EV motor kits are creating immense opportunities. - India (20.9% CAGR):

India is quickly becoming a hub for EV motor production. Government initiatives to reduce oil dependency, coupled with global manufacturers setting up local facilities, are propelling growth.

Clearly, Asia is setting the pace, but Europe and North America remain critical to the global balance.

What’s Driving Consumer Choice?

For everyday buyers, the choice often comes down to performance, affordability, and charging convenience.

- AC motors dominate, commanding an 83.8% market share thanks to their efficiency and ability to handle rougher conditions.

- High-power motors are increasingly in demand, especially in battery electric vehicles (BEVs) designed to rival combustion-engine cars in speed and range.

- Dropping battery costs are making BEVs more competitive, nudging consumers away from hybrids and into fully electric models.

Key Companies Profiled

- Tesla Inc.

- Bosch Mobility

- Siemens AG

- Nidec Motor Corporation

- BYD

- Mitsubishi Electric

- Magna International

- Hitachi Astemo

Related Market Data: https://www.futuremarketinsights.com/reports/electric-vehicle-drive-motor-market