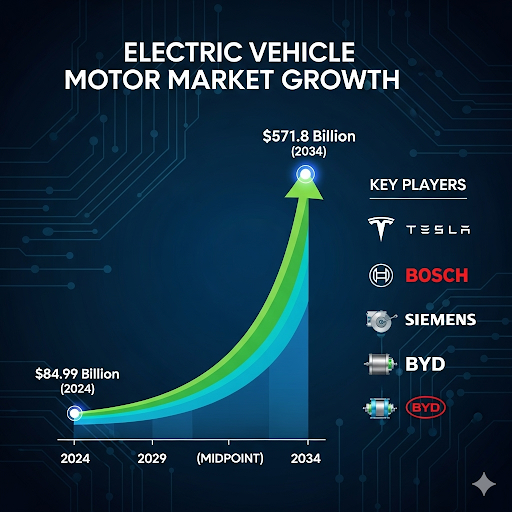

The global shift toward clean energy and sustainable transportation is accelerating at breakneck speed. At the heart of this revolution lies the electric vehicle motor (EV motor)—the crucial component powering electric cars, buses, and even two-wheelers across the globe. According to new forecasts, the EV motor market is on track to grow from USD 84.99 billion in 2024 to a staggering USD 571.8 billion by 2034, representing an annual growth rate of 21%.

This isn’t just a story about numbers. It’s about how industries, governments, and consumers are collectively reshaping the automotive world—and why this decade will be decisive for electric mobility.

The Rise of Electric Propulsion

Back in 2019, the EV motor market was worth just over USD 33 billion. Even through the turbulence of the pandemic years, it doubled to USD 70 billion by 2023, showing that the momentum for electric vehicles was unstoppable. Now, analysts predict that the next ten years will see an even sharper rise, fueled by policy support, falling battery costs, and technological breakthroughs.

So what’s driving this surge? A mix of regulatory pressure and consumer demand. Governments are tightening emission norms, automakers are being pushed to rethink propulsion, and buyers are increasingly opting for electric over gas-powered vehicles—not just for sustainability, but also for performance and cost savings in the long run.

The Tech Race: Motors Get Smarter, Faster, Stronger

The EV motor market is not just about scaling up production—it’s about innovation.

- AC Motors Dominate: More than 83% of EVs today rely on alternating current (AC) motors. They are powerful, efficient, and better suited for long-distance travel and rough terrains.

- High-Power Motors on the Rise: Motors above 200 kW—ideal for performance cars and heavy-duty EVs—already account for over one-third of the market. With luxury EVs gaining traction, this segment is expected to soar.

- Brushed AC Motors Make a Comeback: For years, brushless motors were seen as the only practical option. But manufacturers like BMW are experimenting with brushed current-excited AC synchronous motors, proving there’s room for new-old ideas.

Another big shift is in rare earth usage. Western companies are working to reduce dependence on rare earth metals, while Japanese automakers like Toyota have already developed magnets that use up to 50% less neodymium. This not only cuts costs but also helps address geopolitical supply chain risks.

Regional Outlook: Who’s Leading the Charge?

The EV motor boom is global, but growth rates vary across regions.

- Japan is emerging as the fastest-growing market, with a projected 22.7% CAGR through 2034. Giants like Toyota and Honda are doubling down on EV production, supported by strong government backing.

- India is another rising star. With a 20.9% growth rate, it’s leveraging policy reforms and foreign investment to cut dependence on fossil fuels.

- United Kingdom remains Europe’s brightest spot, growing at 20.9% annually, fueled by aggressive sales targets and clean air policies.

- Germany, home to luxury automakers, is betting big on subsidies—offering buyers nearly USD 10,000 to switch to EVs.

- United States, while slightly slower at 20.2%, still dominates the North American market thanks to its research hubs and Tesla’s manufacturing leadership.

Together, these regions are shaping a new world order in mobility, where electric motors are as central to industry strategy as engines were a century ago.

Challenges on the Road Ahead

While the numbers are promising, the road isn’t without bumps.

- High Prices in Emerging Markets: In countries where affordability is key, expensive EV motors can limit adoption.

- Long Lifespan, Low Replacement: EV motors typically last 15–20 years, meaning the aftermarket (replacement) business is limited compared to traditional auto parts.

- Maintenance Concerns: Even as technology improves, EVs can be costly to maintain in regions lacking proper infrastructure.

Still, these challenges are being countered by aggressive R&D, falling battery costs, and creative financing solutions like leasing and government-backed subsidies.

Why This Matters to Everyday Drivers

For the average car buyer, all of this might sound like technical jargon. But the impact is clear:

- Cheaper EVs: Falling battery and motor costs mean more affordable electric cars.

- Better Performance: More powerful motors mean faster acceleration and smoother rides.

- Longer Range: Efficient motors help squeeze more miles out of every charge.

- Cleaner Cities: With governments pushing EV adoption, urban areas can expect cleaner air and less noise pollution.

Automakers Double Down on R&D

Traditional automakers and EV specialists are in a race to make motors more efficient, compact, and affordable. Partnerships and collaborations are at an all-time high.

- Renault and WHYLOT are teaming up to launch axial flux motors in hybrids by 2025.

- Tesla, Bosch, Siemens, and BYD are investing heavily in advanced motor technologies.

- Eastern and Western manufacturers are both tackling the rare earth challenge from different angles—innovation versus reduction.

Artificial intelligence and connected vehicle technologies are also entering the mix, promising smarter drive systems that can optimize power use in real time.

Related Market Data: https://www.futuremarketinsights.com/reports/electric-vehicle-drive-motor-market